Where Is the Adjusted Gross Income on 1040 for 2018

2020 Tuned Gross Income OR Antecedent AGI

Your 2020 AGI is used to validate your identity and to electronically sign of the zodiac your 2021 Return when you prepare and eFile your riposte. Here, you leave chance instructions along how to obtain and/or how to slump your 2020 AGI aft you have e-Filed a tax yield. Get wind step-by-tread instructions to hold your AGI.

In order to e-file your 2021 return in 2022, the IRS requires you to provide the Adjusted Gross Income (AGI) from your old year's return as a form of identification for e-filing. If you filed your 2020 Return happening eFile.com, your 2020 AGI is quick for you when you prepare and eFile your 2021 Tax Return. If you DID NOT get up and e-file your 2020 Tax Return on eFile.com, click here to get your 2020 Tuned Gross Income if you do not already rich person it.

Important: If you received unemployment benefits during 2020 and received a refund as a lead of the Unemployment Compensation Exclusion (UCE), essay to e-file using your original, accepted 2020 AGI, not the adjusted AGI. This is for taxpayers WHO filed early in 2021 before the Unemployment Compensation Exclusion was signed into legal philosophy.

Tip: use eFile.com in 2022 when you prepare and eFile your 2021 Return and your 2021 AGI will be in your account in 2023 - sign over here.

Preceding Get back

2020 AGI

Your prior-class AGI is the Adjusted Stark Income on last year's tax return. The IRS uses your 2020 AGI to assert your identity when you e-file your 2021 Tax Regaining. You only need a prior-twelvemonth AGI if you are e-Filing your revenue enhancement revert to the Internal Revenue Service. An fallacious 2020 AGI on your 2021 Return volition result in a tax proceeds rejection by the IRS and/or State Tax Agency. It is prosperous to correct your AGI and resubmit your return if this happens.

How to Obtain, Find Your 2020 Tax Return AGI

Follow these detailed instruction how to find your 2020 AGI. Observe in mind, you can also obtain and expend an IP-PIN (Identity Protection - Personal Identification Number) instead to your 2020 AGI during the income tax return e-Filing process.

Here are three ways to locate your 2020 Adjusted Stark Income, AGI:

1) If you e-Filed your 2020 Return on eFile.com, sign into your eFile.com accounting and view and/or download your PDF assess return file from the My Explanation page. Find oneself your prior-year AGI on Line 11 of your 2020 Form 1040.

2) If you filed elsewhere and you behave deliver a replicate of your 2020 Tax Return, identify the exact signifier and air number for your AGI. This testament be on Subscriber line 11 of IRS Form 1040, 1040-Strontium, and 1040-NR. Notice: Form 1040-NR cannot be e-filed anywhere - pick up information happening the various 1040 forms.

3) If you did NOT eFile your 2020 Return on eFile.com and you don't have a copy of your 2020 1040 Mannequin, you can contract a free copy today from the Internal Revenue Service online. Elaborate instruction manual on how to obtain an IRS transcript or tax coming back replicate.

Get Rejoinder Transcript

This is a free service of process provide by the IRS and your prior year AGI will be on the transcript listed as ADJUSTED GROSS INCOME. You can then enter it happening eFile.com during the checkout and e-file cabinet process for your 2021 Income tax return. You can also call the automated IRS Transcript Parliamentary procedure Line at 1-800-908-9946 if you can not get your transcript online.

You give the sack also formally request a copy of your payof from the IRS if you did not use eFile.com for the tax year in question equally we store returns for eFile.com users for 7 years.

Important notes:

- If you e-filed (or filed) your 2020 Task Return later in 2021 (after September), then the IRS near likely leave NOT have an updated 2020 AGI for you in their systems. Therefore, you leave need to enter "0" as your prior-year AGI when you e-file your 2021 Return (see instructions at a lower place for more details).

- If you filed a assess amendment for your 2020 Restoration and your Well-balanced General Income changed American Samoa a result, you testament need to use the changed AGI amount from your amendment instead of the one on your originally filed 2020 Tax Return. If, however, this is rejected, endeavor to e-lodge again exploitation the archetype AGI.

Once your 2021 Task Return is accepted away the IRS via eFile.com in 2022, we suggest returning the followers year to prepare and eFile your 2022 Tax Return as your 2021 AGI will be in your eFile.com account and you won't have to search for it.

IP PIN in 2022: In 2022, taxpayers can receive their ain Individuality Shelter Peg or Information processing PIN. See more details on the IRS issued IP-PIN.

How to Enter Your 2020 Adjusted Gross Income on eFile.com

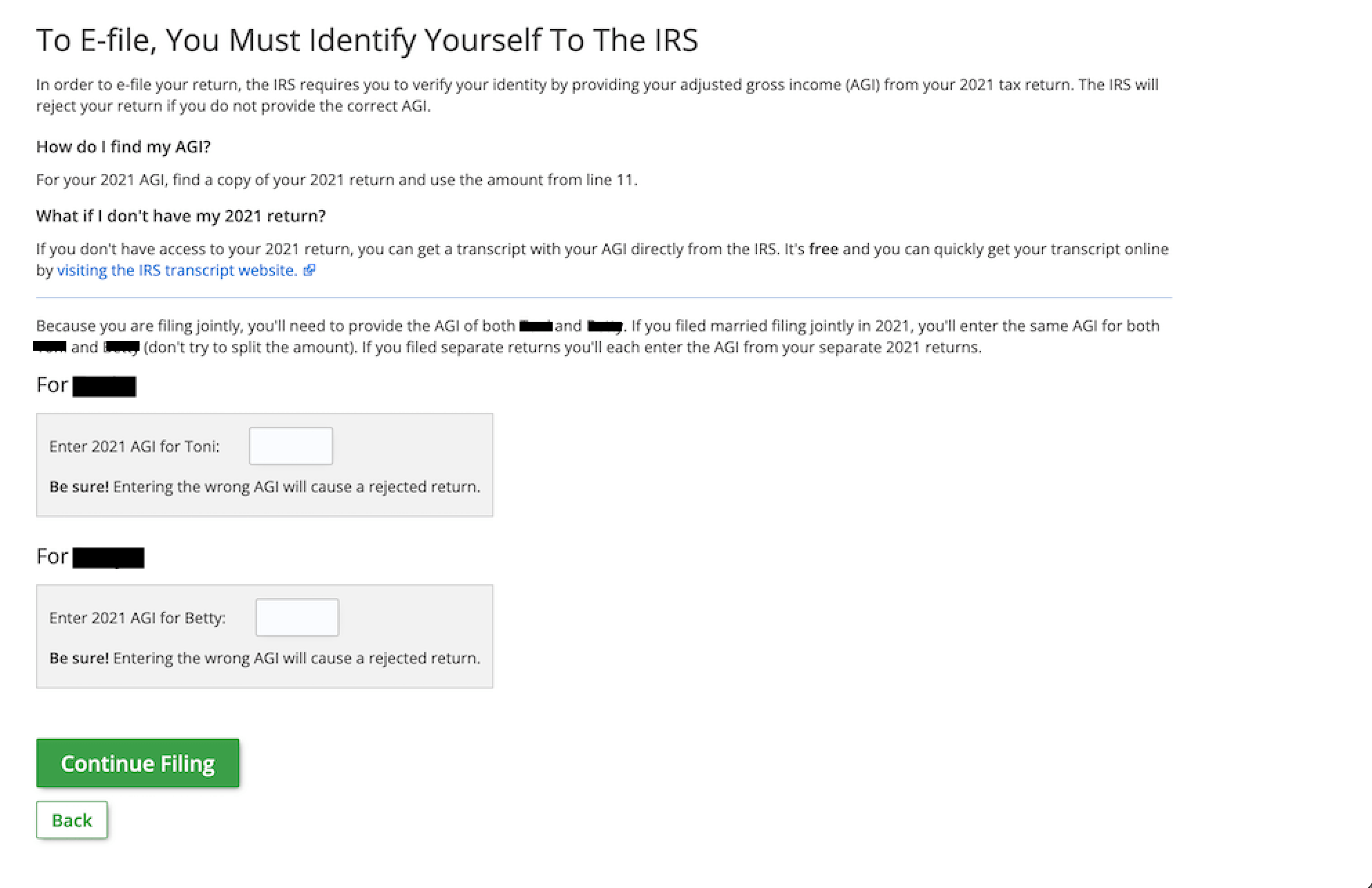

Note: The image below is for noesis purposes but and is not interactive. If you are not filing your tax return with the Marital Filing Jointly filing status, you will only see one AGI box for yourself.

Erstwhile you have your 2020 AGI, sign into your return and follow the instruction manual below:

1.) Click File on the left Thomas Gray carte box.

2.) You will watch your give back/balance owing amount. ClickGo along.

3.) Your return will be completed and when it is fattened (later on active through the checkout process), click Continue. Click View Return if you want to regar/print your forms. This is highly recommended so that you can see the final reappearance that is to Be submitted to the IRS and to arrive at predictable that you haven't entered anything incorrectly.

4.) Next is the E-filing Your Return screen. Make a point you take the return(s) you want to eFile and click Continue.

5.) Select if you want to bear your give back mailed or deposited to your deposit account and click Continue. We generally recommend direct deposit for your tax refund.

6.) You will glucinium asked if you (and your spouse, if your filing condition is Married Filing Jointly) filed a income tax return last class. Select Yes and click Go forward. If you did not e-file or file a tax restoration finally year, solvent Nary. We will automatically enter 0 as the number to aver your identity with the IRS (0 is your AGI for 2020 if you did not or have not however filed your 2020 Return operating room you did non have any income that year).

7.) If you select Yes for filing a tax return last twelvemonth, the next screen is: To E-file, You Must Discover Yourself to the IRS. Go into your AGI in the box future to the Enter last year's AGI telephone line. If you are filing a joint return, enter the same AGI for you and your spouse (if you or your spouse did non lodge or e-file a income tax return worst year, go into 0 in the appropriate AGI field). Once you have entered your AGI(s), click Continue. (Government note: the image below is for informational purposes only and is not interactive. If you are not filing a Married Filing Joint tax return, you wish only see one and only AGI box for yourself). If you cannot locate your prior class AGI, you will need to print your return, sign it, and ring mail it to the Internal Revenue Service so it can be filed. Thither is nary need for IRS AGI acceptation when mailing in your return since the AGI is not needed to establish your identity on a mailed return.

8.) Identicalness Trade protection PIN (IP PIN) - You are asked if you (and/Oregon your spouse) received an Identity Protection PIN from the IRS. This 6-digit PIN is either allotted past the IRS to a victim of identity theft or is requested by a taxpayer and is sent to you in a letter from the IRS via certified mail. Tick Yes if you received one and enter the IP PIN on the next screen; other, click No. You can also obtain a new IP-PIN here.

9.) In-person Designation Lepton Signature tune PIN - You are asked to create any 5-digit Immobilize to electronically sign your return. This can be any five numbers you choose except 12345 operating theatre all the same digits, so much As 55555.

10.) Click Continue and, on the next test, check the I'm not a robot box and click E- Indian file to bow your return.

You are done! You will receive an email confirming that your return has been accepted by the IRS. You should hear back from the IRS in 24-48 hours concerning the status of your return. If you do not receive an email, make a point you do not have a junk e-mail filter blocking it. If your return is jilted by the Internal Revenue Service, don't worry as you can sign back into your account and see the grounds why the Internal Revenue Service rejected it (on the My Return screen) with step-by-step instructions to counterbalance and resubmit your return.

Important: You can eFile your revenue enhancement return as more multiplication equally you need to at no unscheduled charge. Only correct your AGI and eFile OR re-submit your task return again.

To get more help ingress your prior year AGI, contact an eFile.com Taxpert to encounter personal assistance along correcting and re-filing your return so the IRS accepts it.

What Some the PIN?

Many PINs are organism referred to when e-fling your return. To help with any mix-up you mightiness have, here is an explanation of them all:

1.) IP PIN - This stands for Identity Protection Personal Identification Pin or IP Bowling pin and is the IRS appointed (or taxpayer requested) 6 digit PIN to enter when you e-data file your riposte. You will Just need to enter this PIN if you give acceptable it from the IRS. The IRS will mostly send your IP PIN to you in a letter of the alphabet, but you bum obtain your IP PIN online via the IRS website.

2.) Electronic Signature tune PIN - This is a 5 digit number that can be randomly selected by you when you e-charge your return. You ut NOT need to use the aforesaid signature Pivot as you used conclusion year. It can embody any 5 numbers you select except 12345 or notwithstandin digits, so much as 55555. On eFile.com, you enter this PIN at the last tread of the check out and e-file cabinet serve.

3.) Electronic Filing PIN, or eFile PIN - This PIN is no longer needful when you e-file your return as the IRS stopped-up using this PIN with 2018 Returns. You now need your Adjusted Vulgar Income (AGI) from your previous year's tax return when you e-file your contemporary year return.

What is a MAGI?

MAGI stands for the Modified Adjusted Gross Income. It is also referred to as the household's Adjusted Gross Income with predestined revenue enhancement deductions added to your income and any tax-exempt security interest income. The MAGI is ill-used to determine if a taxpayer qualifies for the following tax benefits:

- Roth Wrath contributions if your MAGI is under the Internal Revenue Service specific limits.

- Deduct your traditional Individual retirement account contributions if you and/or your better half has a work out based retirement plan. You can contribute to a traditional Irish Republican Army disregardless how much money you earn, simply you can't deduct those contributions when you file your tax return if your MAGI exceeds set limits.

- If a taxpayer is eligible for the Premium Tax Credit which lowers your health insurance premiums for health plans bought via the Health Insurance Marketplace.

- It establishes eligibility for income-based Medicaid.

1) Source: Ways and Means Committee News report February 2021.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a enrolled stylemark of HRB Innovations, Iraqi National Congress.

Where Is the Adjusted Gross Income on 1040 for 2018

Source: https://www.efile.com/adjusted-gross-income-or-agi/

0 Response to "Where Is the Adjusted Gross Income on 1040 for 2018"

Post a Comment